Founder of The Jewels Club, Andrew creates platforms that connect the world of jewellery through community, content and access.

India powers 90% of global diamond cutting and polishing and is a key source of gold jewellery for US consumers. On 6 August 2025, President Trump imposed an additional 25% tariff atop the existing rate, taking the total to an earth-shattering 50% on many jewellery items. This move — ostensibly in response to India importing Russian oil — delivers a sharp economic blow to a vital sector of India’s economy.

But it’s not just industry feeling the heat. In an unusually strong statement, India’s foreign ministry branded the tariffs “unfair, unjustified and unreasonable,” adding that “India will take all necessary measures to safeguard its national interests and economic security” . That kind of official pushback rarely lands in trade write-ups — but it underscores how high the political stakes now are.

“Modi vs. Trump: 50% Tariffs Ignite a Gold & Diamond Standoff”

India processes about four in five of the world’s polished diamonds, primarily for US markets. American buyers represent roughly 40% of the value of these exports. A 50% duty threatens to collapse this trade, as exporters warn volumes could fall by half within 12 months — sending tremors through Surat’s polished diamond hub and the one million+ workers who depend on it.

The US typically imports about $10 billion in Indian gold jewellery each year — nearly one-third of the nation’s gem and jewellery export total. With tariff barriers doubling, Indian designs face steep pricing disadvantages. Against the backdrop of soaring bullion prices, many artisans and small workshops — especially in underprivileged areas — may be edged out entirely.

Adaptation is underway — but uneven. Larger exporters are eyeing offshore assembly in the UAE, Mexico, or Vietnam, hoping to re-enter the US under more favorable terms. Others are rerouting to markets in the Gulf and Southeast Asia. However, this kind of shift demands capital, regulatory agility, and time—the very things smaller players lack.

India’s internal market, valued at about $85 billion and projected to hit $130 billion by 2027, offers some buffer. Cultural festivals and ongoing wedding demand maintain jewellery momentum. Events like IIJS Premiere 2025, which logged ₹70,000 crore in deals, reveal strong domestic appetite—but inward pivoting isn’t an instant cure for exporters accustomed to polished US channels.

Economists estimate the tariffs could dent India’s GDP by 0.3–0.5% in FY26. The knock-on effects reach beyond jewellery — textiles, footwear, carpets, and luxury handicrafts are all vulnerable. Clusters like SEEPZ SEZ in Mumbai, where 85% of output heads to the US, could see mass job losses. The ripple extends to gemstone traders, refiners, packaging suppliers—key strands in a delicate supply chain.

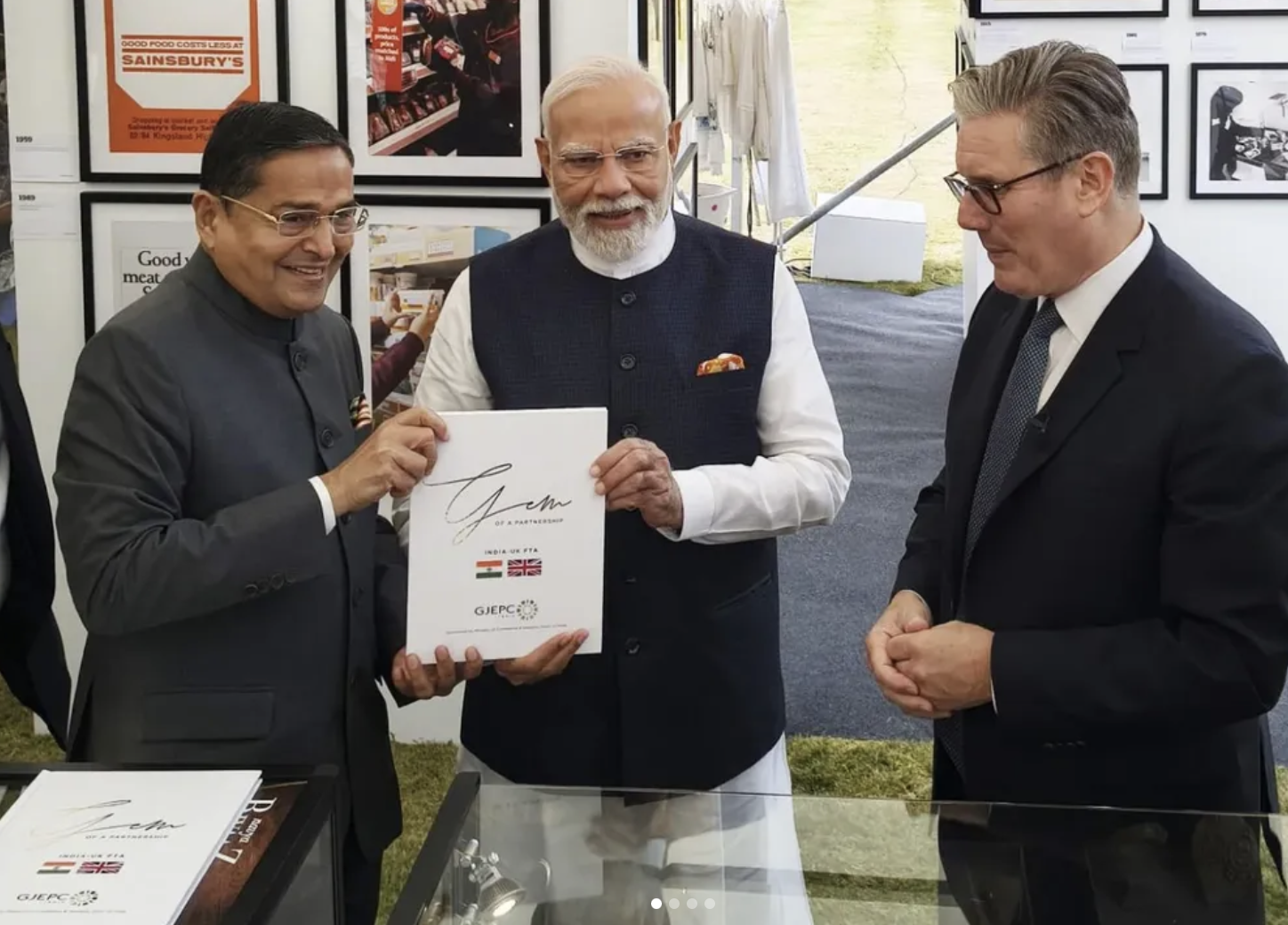

While tensions with Washington escalate, New Delhi’s relationship with London is moving in a very different direction. Just last month at Chequers, GJEPC Chairman Kirit Bhansali presented Prime Ministers Narendra Modi and Sir Keir Starmer with Gem of a Partnership — a publication celebrating the India–UK jewellery trade and marking the signing of a historic Free Trade Agreement. The deal underscores how reducing barriers and fostering collaboration can strengthen markets on both sides, offering a sharp contrast to the punitive measures currently straining India–US trade.

“Last month at Chequers — GJEPC’s Kirit Bhansali presents Gem of a Partnership to PM Narendra Modi and Sir Keir Starmer, marking the India–UK jewellery trade deal.”

This isn’t revenge politics playing out in isolation — it’s a full-blown test of India’s export infrastructure and strategic resilience. With official outrage already at hand, exporters must now get proactive: recalibrate supply chains, reinvest in nearby manufacturing bases, and strengthen the home market proposition. The difference between resilience and collapse will hinge on speed—and the willingness to reimagine how, where, and whom India sells to.

“President Trump needs to get in line with fair, balanced trade. Tariffs this steep serve no one — buyers lose choice, artisans lose livelihoods, and the world loses the exchange that keeps our industry alive.”

Andrew Martyniuk - Founder, The Jewels Club

The Jewels Club founder Andrew Martyniuk

UK Jewellery Sector Demands Government Action for Small Businesses

UK jewellery and allied craft leaders unite to call for urgent government reform, highlighting the structural challenges facing small and microbusinesses.

READ MORE

A Pact Signed in Power — and Sealed in Gold

India–UK FTA signed by Modi and Starmer unlocks $2.5bn trade vision for Indian jewellery exports

READ MORE